Traders must stay abreast with the most current NTMs applying to their products to ensure a comprehensive approach to budgeting and compliance.

Which non-tariff measures may impact the different overheads involved in exporting? Let’s take a look at common NTMs, tips for determining which measures apply, and tools to help facilitate compliance.

Please note: This article comes from a neutral perspective and does not aim to either endorse or deride any foreign trade policies. The article also does not aim to promote any policy changes or give any subjective views on them. Instead, this article intends to inform the reader about NTMs and how they may affect a global trader’s budget and compliance measures.

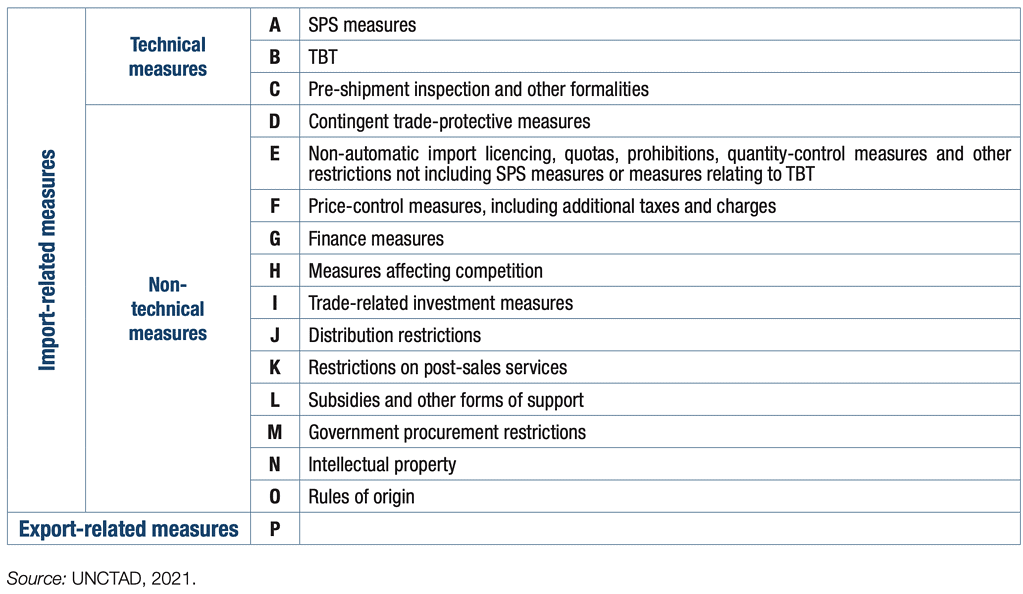

Non-Tariff Measures by Category

To get started, let’s get an overview of NTMs by category. The previously mentioned UNCTAD classifies non-tariff measures by chapter using the following table:

Each of these NTM chapters comprises an array of regulatory policies, which varies per country and can impact the cost and procedures involved with international trade.

What are some examples of specific non-trade measures that fit into these chapters?

Common Non-Tariff Measures

Let’s zoom in on just a few non-tariff measures listed above. We’ll describe these categories and provide examples of these measures to illustrate their effect on trade processes.

Sanitary and Phytosanitary (SPS) Measures

This non-tariff measure classification aims to protect the ecological health and safety of nations engaging in trade.

“SPS measures include all relevant regulations, requirements, and procedures used to ensure the safety of agricultural products for people, plants, and animals,” explains the Office of the United States Trade Representative. “This includes processes and production methods; testing, inspection, certification, and approval procedures; quarantine requirements for transporting animals or plants; procedures and methods of risk assessment; and packaging and labeling requirements related to food safety.”

Some nations have SPS agreements facilitating trade between nations. Meanwhile, others dispute the validity of certain standards. Regardless, traders must comply with SPS applicable measures.

Pre-Shipment Inspection (PSI)

Some importing countries require a third-party pre-shipment inspection to ensure the value of certain goods set for export.

“Pre-shipment inspection is the practice of employing specialized private companies (or ‘independent entities’) to check shipment details — essentially price, quantity and quality — of goods ordered overseas,” says the World Trade Organization (WTO). “Used by governments of developing countries, the purpose is to safeguard national financial interests (preventing capital flight, commercial fraud, and customs duty evasion, for instance) and to compensate for inadequacies in administrative infrastructures.”

If an importing nation mandates pre-shipment inspection, the importer typically arranges the PSI using a contractor. The exporter is expected to cooperate with the inspection. Only after a ‘Clean Report of Findings’ is issued can the product be shipped and cleared through customs.

Intellectual Property

One of the fastest-growing trade policy fields is non-tariff measures for intellectual property trading.

“‘Intellectual property’ refers to creations of the mind. These creations can take many different forms, such as artistic expressions, signs, symbols and names used in commerce, designs and inventions,” explains the WTO. “Governments grant creators the right to prevent others from using their inventions, designs or other creations — and to use that right to negotiate payment in return for others using them.”

Intellectual property non-tariff measures attempt to protect this valuable information and facilitate the legal transfer of this property to others.

After highlighting just a few broad non-tariff measures at play in international trade, it’s clear that traders must be highly attentive to all regulations that may affect their processes. How can you boost your compliance strategy? Compliance starts with defining which NTMs apply to your operation.

How to Determine Which Non-Tariff Measures Apply

Unfortunately, finding out which NTMs apply to your import or export is not as simple as querying “How do I know which non-tariff measures apply” in a search engine. Why?

Non-tariff measures are both country and product specific. The applicable NTMs will depend on the product in question, the country of origin, and the country of destination. As a result, you won’t be able to plan for non-tariff measures until you define the specifics of your intended transaction.

However, the International Trade Centre has produced a free tariff and non-tariff lookup tool where you can find regulatory restrictions based on the country of origin, destination, and product HS6 code or name.

For example, presume you want to import coffee beans from Costa Rica into the United States. In that case, you can find the most current tariffs and non-tariff measures in place, including testing, inspection, labeling, and packaging requirements.

Still, finding out which tariff and non-tariff measures are in place is just the beginning. There are various tools to help simplify the process of understanding NTMs and their application. Which other tools can help you comply with these measures?

Global Trade Compliance Tools

At OCR Global Trade Management, we help traders improve the visibility, efficiency, and profitability of their export and import processes at every step. With our user-friendly software solution, you can centralize managing international supply chains, logistics, and cross-border trade in a single platform.

Our robust global trade management tools can help you with global licensing and permit applications, product classification, technical data transfer management, export, and customs management, and so much more.

Get in touch to discover solutions to keep you compliant and confident in the world of global trade.