ASSIGNING THE CORRECT HTS CODE

The HTS code or the Harmonised Tariff Schedule code is a coding system that has been designed by the World Customs Organisation (WCO). This code is used to identify the goods that are traded internationally. Every exporter needs to make sure that the correct codes have been assigned to their products. Exporters also need to keep in mind that HTS codes can be changed from time to time. It is extremely important to keep track of these changes. An automated software mechanism could prove to be an exporter’s biggest support system.

ADHERING TO DOCUMENTATION REQUIREMENTS

It is also important for exporters to make sure that they are presenting all the required documents. For instance, if you are exporting your products to a country which has a free trade agreement with the UK, you need to supply a certificate of origin. Similarly, other documentation such as licenses, exceptions, and exemptions also need to be in place. Not adhering to any of these requirements may result in hefty penalties for your business. Such penalties may include monetary fines, revoking of trade privileges, or even imprisonment. In order to avoid this situation, exporters need to ensure that they have detailed historical documents related to all their exported goods.

YOUR COMPANY’S NEXT STEPS

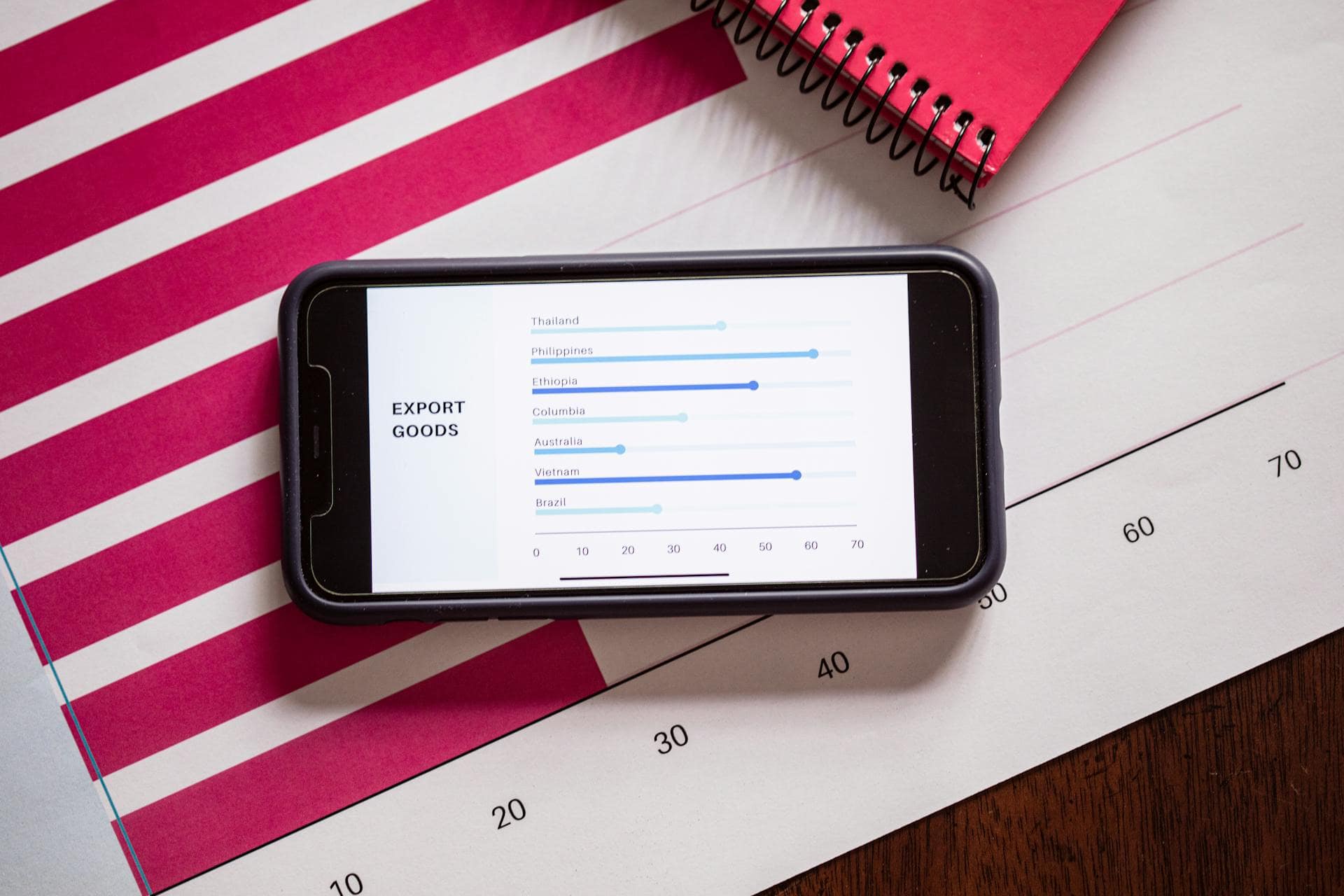

To sum up, all exporters need to be fully aware of product classification lists and make sure that their products are completely compliant. OCR provides you with configurable product classification solutions that could help you in negating all compliance risks. These solutions help you in customising compliance workflows, respond to audit requests, and update you in terms of any regulatory changes. Please contact us to find out more about how we can help you with our product classification offerings.